Top Mutual Funds for SIP

“If your money can not grow when you are sleeping then you will keep working throughout your life”

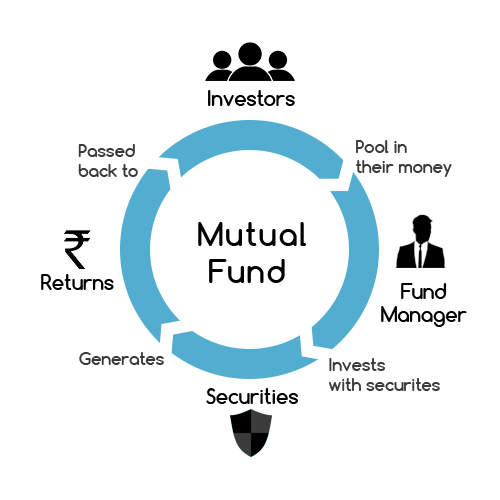

Mutual Fund refers to professional pooling of assets from shareholders in stocks, bonds and other securities. The term mutual fund presents a wonderful display of cooperation that brings together diverse people with an amount of 50,000 to as much as 50,00,00,000 for the purpose of investment. And the income / gains generated from this collective investment is distributed proportionately amongst the investors after deducting applicable expenses and levies.

As a seafarer investing in a mutual fund is a comfortable process as the fund managers do the research for you , select securities and monitor the performance. But for a seafarer who is hearing Mutual Funds for the first time, need not worry as we are going to provide with an elaborative piece of information on investment in mutual funds in this blog.

TYPES OF MUTUAL FUNDS

There are two types of mutual funds –

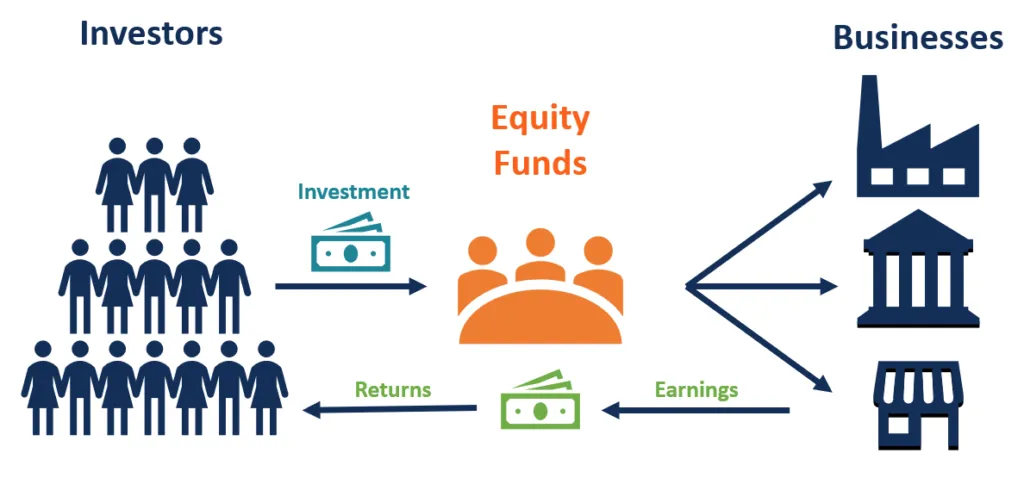

- EQUITY FUNDS – also known as growth funds is a mutual fund scheme that invests predominantly in shares/stocks of companies. This scheme is helpful for the growth of the investment portfolio of seafarers. It is recommended to invest in Equity funds during the inception of the investment journey. On the basis of how the capital market values an entire company’s equity, mutual funds are further divided into –

- Large Cap Funds

- Mid Cap Funds

- Small Cap Funds

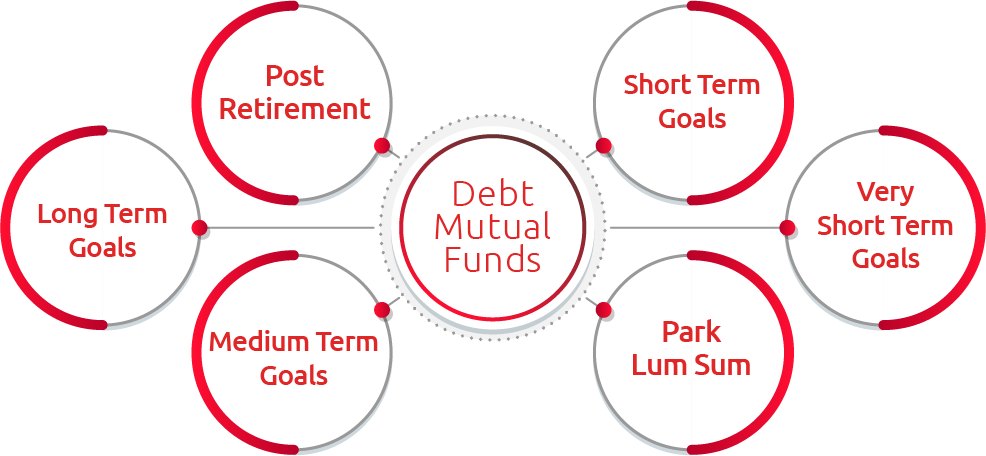

- DEBT FUNDS – also known as fixed income funds is a mutual fund scheme that invests in fixed income instruments like bonds, debt securities etc. This scheme ensures financial stability to the investment portfolio of seafaring professionals. As an officer/engineer on ship there is less to no use of opening debt funds as your savings are preserved in an NRE account, making your transactions smooth and tax-free.

As a sailor, you should always invest in minimum 5 mutual fund schemes. The minimum amount of investment allowed in any Mutual funds is INR 5,000. Mutual funds enable a steady growth of money at an average interest rate providing stability to your portfolio. Suppose you decided to invest INR 10,000 per month in Mutual Funds. How should you go about it then ?

Invest in Large Cap scheme –

These funds invest major proportions of their assets under established institutions known for having reputation in the market like Tata, Britannia etc. You can invest in active funds like Axis Blue-chip, ICICI Blue-chip or Index funds like HDFC Sensex Index fund. Large cap funds are perfect for risk-averse seafarers.

Suppose you create a SIP of INR 2,000/week in order to invest INR 10,000 per month. Since there are 5 trading weeks in a month, the regular step-by-step investment will provide you a good rupee cost average.

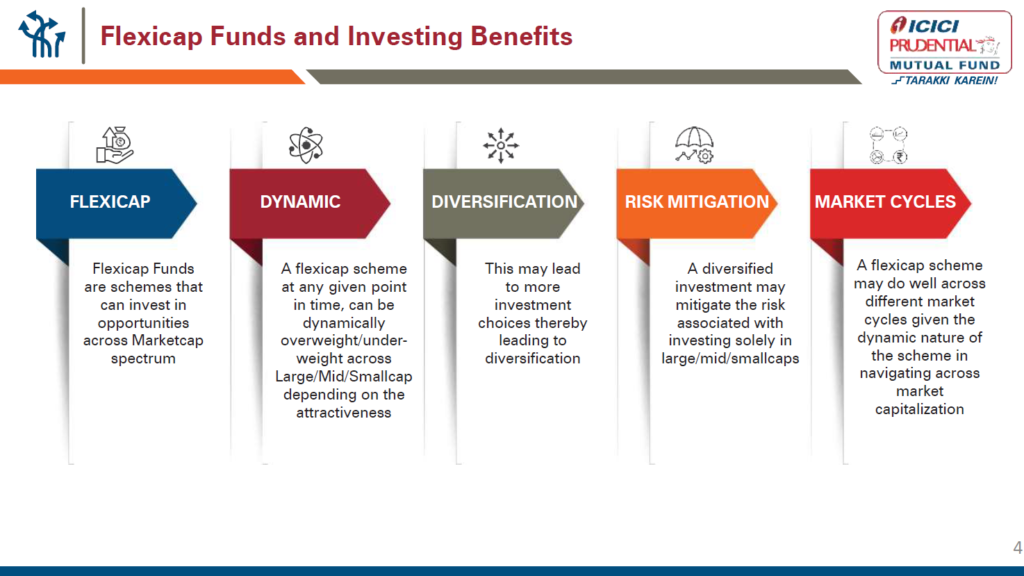

Invest in Flexi cap schemes –

These funds provide fund managers with greater investment choices and are not restricted to invest in companies with predetermined market capitalization.

Invest in Small cap schemes –

If you start investing in mutual funds small cap schemes as a 3rd Officer and continue there for next 20 years. You will see how small cap funds will transform into one of the biggest wealth generator as the small companies grow to become more established with time.

Imagine those who invested in the small cap funds of Havelis in 1980-1990. Today the company has made a reputation of its own with an impressive track record.

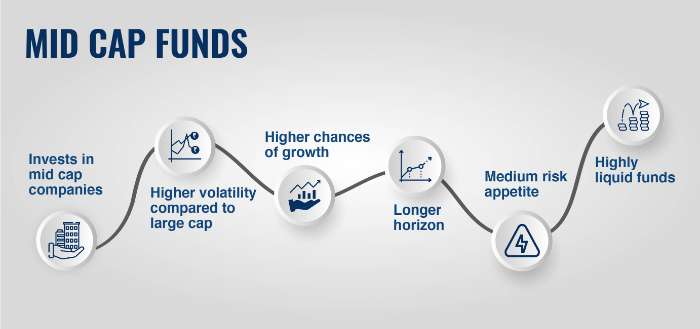

Invest in Mid cap funds –

Such stock funds invest in firms with established businesses. Overall, this is a right decision to invest in mid-cap companies that tend to offer more growth potential than large-cap stocks and with less volatility than the small-cap segment.

Invest in Foreign funds –

These funds invest in businesses outside the country of origin of the investor. Foreign funds are used as long-term core holdings as they generate higher returns than any mutual fund schemes. Seafarers investing in this should be aware about the risk associated with it.

It is a brilliant feeling to see your money grow on weekends when you’re relaxing. Mutual funds are a liquid market, meaning it is relatively easy to trade and find a buyer for them. The same cannot be said for several assets. Hence, seafarers investing in mutual funds from an early age are looking at the bigger picture of a prosperous financial life in the later phase.

Disclaimer :- The opinions expressed in this article belong solely to the author and may not necessarily reflect those of Merchant Navy Decoded. We cannot guarantee the accuracy of the information provided and disclaim any responsibility for it. Data and visuals used are sourced from publicly available information and may not be authenticated by any regulatory body. Reviews and comments appearing on our blogs represent the opinions of individuals and do not necessarily reflect the views of Merchant Navy Decoded. We are not responsible for any loss or damage resulting from reliance on these reviews or comments.

Reproduction, copying, sharing, or use of the article or images in any form is strictly prohibited without prior permission from both the author and Merchant Navy Decoded.