Financial Management of Seafarers

This blog required a lot of effort and hard work to come in present shape. To start with, this blog is written by Chief Engineer Praneet Mehta but not because I have great knowledge of finance rather be honest, I feel I should be the last one on Earth to give anyone advice on FINANCE MANAGEMENT.

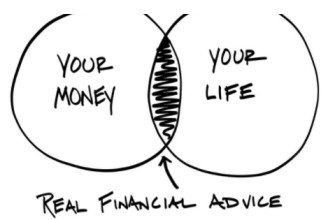

The purpose of writing this blog is to share the Failures of a few seafarers including me in the form of true stories but with different names, so that all the readers get to learn from others’ mistakes. However, this blog is just the tip of an iceberg of the topic, there are many things that this blog doesn’t cover for instance, investment for seafarers, financial advice for seafarers, retirement plan for seafarers and many more. To learn more about such financial topics for seafarers you can check out our free Financial Series for seafarers.

TIP No. 1

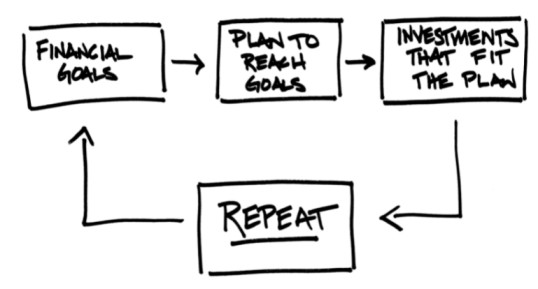

START PLANNING FROM THE DAY YOU START EARNING

If we ask a simple question to ourselves, why do we join Merchant Navy and the maximum number of people will have a simple answer as we joined Merchant Navy for Earning money and becoming RICH. Now the definition of RICH can be different but mostly it relates to the Property or Bank Balance you have. Finance Management from the day you start earning is very important and if you learn this art early you will surely be RICH in true means.

“ONLY MONEY YOU SAVED IS YOURS”

TIP No. 2

MARRIAGE AND CHILDREN

Too early to think about Marriage or Children but having the right knowledge is very important.

You must start investing early for your children’s education and marriage after her/his first birthday. To give advice is very easy and that is what I am doing in the Blog but to follow the same advice is what defines your future. It is not good advice or a good tip that decides your future but the willingness to execute that advice and in a disciplined way is the most important part. For example, I have a son who is 4 years old, I still have not invested anything for him, which is a failure on my behalf but I do know people who practiced this diligently and in the latter part of life, they had nothing to worry of.

TIP No. 3

LIFE INSURANCE AND MEDICAL INSURANCE SHOULD BE YOUR FIRST INVESTMENT IN YOURSELF

Go for LIFE INSURANCE as well as MEDICAL INSURANCE at the earliest stages. It is the best form of investment that you can make on yourself. When one talks about Life Insurance, please do not fall into Agents’ traps of different policies with different plans or Money Back Policies. Just go for simple TERM Life Insurance and the earlier you start the lesser will be the Premium. In the case of Medical Insurance, one can include his wife and children once got married. These topics have a lot to be covered in detail, so a separate blog on the same will surely be made in detail.

TIP No. 4

“MONEY DESTROYS ITSELF IF NOT INVESTED”

When it comes to investing your money, just don’t follow what others say. Follow your own passion, learn all about that particular investment and then invest. Like a person with good enterprising skills might guide you to invest in Business but you might be good in the Share market or Mutual Funds. Do not invest in anything because someone showed you a very good picture, there have been cases where people have cumulated a lot of losses just because they believed in others more than themselves.

In case your Risk-taking capacity is low then some safe investments are as below:

Once you have money to invest, one can go for a PPF (Public Provident fund) and NPS (National Pension Scheme) accounts. Start your PPF account early even with the low amount in a NATIONALISED BANK other than the bank where you have your NRI account. Later you must increase the amount deposited as per your earning capacity. For NPS the minimum amount is 6000 and start early to get better benefits of it.

About 20% to 30% of your income must be invested in FD(s) for about 2 to 3 years and reinvest this money rather than wasting it uselessly and also go for POST OFFICE MONTHLY INCOME SCHEMES (MIS) you have to pay some amount monthly and later get it back after maturity after decent interest; again, reinvest this amount and make your principal amount larger and larger with time.

Most importantly do not provide any information about your earnings from any source, your investments, the property you own, share stocks, mutual funds to anyone. This information must be provided to the only bank where you apply for a loan and of course to the income tax office.

TIP No. 5

AVOID LOANS FOR GADGETS AND CARS. AVOID CREDIT CARDS

Avoid using CREDIT CARDS as it is the most dangerous debt trap with a very huge amount of interest charged.

Do not fall for any emails or messages which ask for your password, UPI pin, etc. If you receive any such message, contact your bank soon.

When buying stuff like an expensive car, do not be materialistic with the loan amount, once save on your own that too without affecting any other funds, then go for such expensive commodities. You must be aware that putting loan pressure onto you at an early age and too in the time being where you could not use it yourself, as most of your early contract will be of long duration than higher ranks. Also, such loans will make you sail more at lower ranks and that would affect your promotional capabilities as well.

“Remember you actually start earning a good amount when you become a Second Engineer or a Chief Officer, you can then take LOAN for a house or flat. Most importantly you will be able to repay the loan soon as well.”

TIP No. 6

HAVE PATIENCE: Money does not grow on trees which can be reaped anytime you want to. Have patience give about 15 years of time to your investments to get the best possible results.

We must have a clear-cut plan, which should comprise of what amount could be invested where. A plan must cover all aspects of investments like, from expenditure budget to emergency funds, from long-term investment for a family to short-term high-rate interest money-back policies. One must be ready to take calculated risks to get a better return with time, this also keeps seafarers busy when they are on their leave period

TIP No. 7

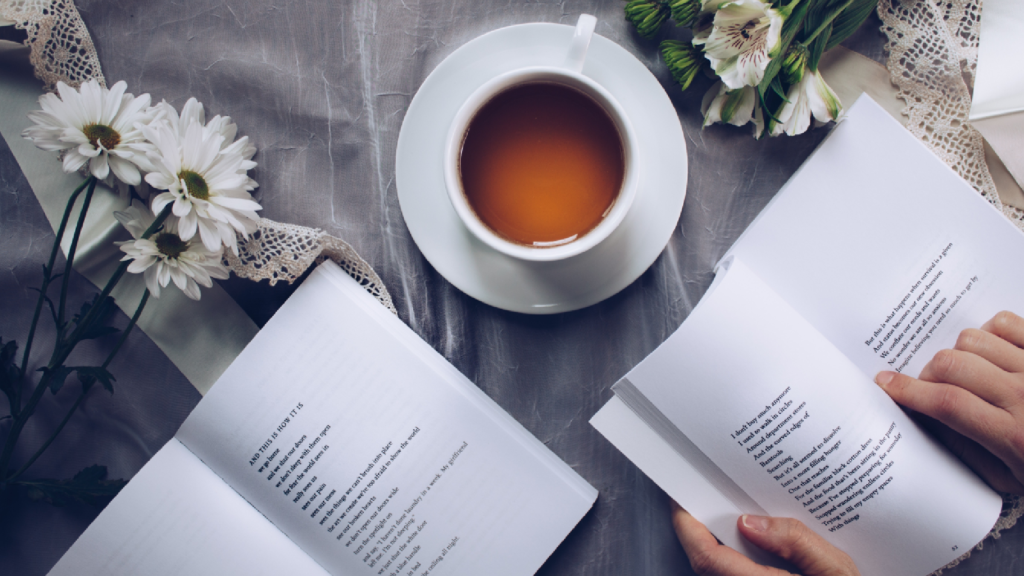

READ AND LEARN

Read BOOKS to understand the concept of Financial Planning better. The three most recommended books are:

1. Rich Dad Poor Dad by Robert Kiyosaki with Sharon Lechter

2. Richest Man in Babylon by George S. Clason

3. Financial Planning for Seafarers by Rajeev Kaushik

TIP No. 8

AVOID SPENDING IN THE FIRST MONTH OF SIGN-OFF. THE RELATIVE FACTOR

This was the best TIP that I got from a Captain recently and that was, don’t make any investments in the first month of your Sign off. Did I ask him why? And he told me that you will see that Praneet that most of your futile investments are made in the time that you have signed off. I realized that it was true, I bought a 140$ watch at Airport to never wear it in my life. This money could have been given to someone who needed it badly. Sometimes we buy a lot of stuff at AIRPORT but don’t use it like I remember that I recently signed off from Egypt and bought 100$ perfume only to find it to be FAKE.

When you come from Ship, your relatives might ask you for funds, please try and avoid unless URGENT. Because today you will be nice while lending money but will become worse when you ask for your own money back. You are going to lose relationships as well as money. Help only if EMERGENCY and then have the courage to forget the money or ask with patience. Because a high probability is you will lose money and relationship as well. There have been so many cases where both relationships and money have been lost and regretted later.

“LEARN TO SAY NO, WHEN REQUIRED”

TIP No. 9

FAMILY COMES FIRST

A calculator or computer can tell you, how much you have earned or lost over a period of time. But a computer can never tell, how much you could have earned. Similar is the case with the blessings of our parents. They give their everything for our wellbeing and now it’s our turn to take good care of them. There is nothing better than BLESSINGS OF YOUR OWN PARENTS.

If you are the eldest son, then taking responsibility at an early age will make you a better person. So, feel happy if you have struggles to face, a house to make, a younger sister to get married, and ensuring parents have a settled life.

Along with all these responsibilities, there are a few things that one must not forget and they are, you should not get emotional and should be rational while investing in your family.

Let me share in the form of a story, a friend of mine had two younger brothers, being the eldest one he had the responsibilities to fulfill and he did that diligently. He made a big house at his ancestral home and most of his savings were invested there. Parents had the power of attorney and all his funds were being used for the well-being of all the family members. Now years later when parents expired, the big palatial house was divided into three equal parts even though the elder brother had made all the investments. Today he feels bad that his own brothers, when it came to money matters, were selfish. Why regret, when we can learn from such true stories.

So, remember,

- Keep your Finances in your own hand, always keep a lookout on where your money is going and why as well.

- One should never give his/her Power of Attorney to anyone. Unfortunately, our job profile is such that we have to trust someone or the other. The first name that comes is Parents and if you are a single parent child, there will be no issue but if you have siblings then be careful. Second choice is wife and once that trust build up in 5-6 years of marriage, you can give her the Power of attorney

- If you are buying a house, make sure it is in your name alone and not in joint account with your parents. This will keep your investments safe and free of any legal tangles.

A young seafarer might feel thrilled and fascinated towards a lavish lifestyle but we must understand that life is a marathon. Marathon is won with great plans, best implementations, and infinite patience. Falling for expensive trips or other materialistic things will not last long. Unfortunately, I have witnessed some very elderly Chief Engineers and Captains still sailing at the age of 60 -62 years. The worst part is that they are not sailing because they are enjoying sailing but because they don’t have an option but sail and make up for the blunders made in the past. I guess we all need to learn the importance of FINANCIAL PLANNING and invest wisely.

Lastly, I am a failure myself when it comes to Financial Planning but I have been mentored by Rajeev Kaushik Sir for this blog, and a special thanks to Captain Nair who guided me well when I was sailing with him.

Lastly remember, “THE ART IS NOT IN MAKING MONEY, BUT KEEPING IT.”

Disclaimer :- The opinions expressed in this article belong solely to the author and may not necessarily reflect those of Merchant Navy Decoded. We cannot guarantee the accuracy of the information provided and disclaim any responsibility for it. Data and visuals used are sourced from publicly available information and may not be authenticated by any regulatory body. Reviews and comments appearing on our blogs represent the opinions of individuals and do not necessarily reflect the views of Merchant Navy Decoded. We are not responsible for any loss or damage resulting from reliance on these reviews or comments.

Reproduction, copying, sharing, or use of the article or images in any form is strictly prohibited without prior permission from both the author and Merchant Navy Decoded.

Insightful Sir.

Thankyou

So much new information….

Thank you

Hope it helps!

Well explained, it is useful for many of us

I’m glad it helped!

Fabulous sir ☺️

Thankyou!

Thank you Sir, for this Valuable Information 🙂

I hope you put it to good use!

More important than any technical blog. Thank you so much Chief Engineer Praneet Mehta sir.

Every topic has it’s importance, but I’m glad you found it useful.

Thats a good information…

But at what position we should be in order to buy expensive cars and bikes.

As it is my dream to have a superbike

I’ld say at the rank of 2nd engineer or chief engineer you could slowly see take your dream taking shape! Best wishes!

Excellent blog

Thankyou!