Are seafarers given the status of NRI?

Non Resident Indian (NRI) is a person who stays in India for less than 182 days during the period of the foreseeing financial year for the purpose of employment or business activities. The contractual nature of work in the Merchant Navy makes a seafarer stay out of their home country for months or so giving them the status of NRI.

Suppose there is a person who was raised in India. He completed his schooling and joined the merchant navy after pursuing a diploma in marine engineering. Till now, he has been living in India for 182 days or more in a financial year. Hence, he was termed a resident of that country. But as soon as he starts sailing with shipping companies as a professional in the merchant navy, he will be under contract for months or so. This will make his stay in India less than 182 days during that financial year making him an NRI. Let’s dive into some advantages and disadvantages for seafarers being NRI in India.

Advantages of being NRI

Tax-free income

Tax on the income of a seafarer is applied based on his/her residential status. If a ship crew member works outside India for 183 days or more during the financial year as per his/her CDS or passport, his/her residential status changes to a Non-Resident Seafarer. The overseas salary of a non-resident seafarer is not taxed in India. But here’s a catch: if you are not depositing your salary overseas into your NRE Account, you will have no income tax exemption. Any Indian professional working as a resident in the country pays 35% of their income as tax to the government. Imagine you saving those extras by depositing them responsibly in your NRE Accounts. No wonder being NRI works surprisingly well for a seafarer.

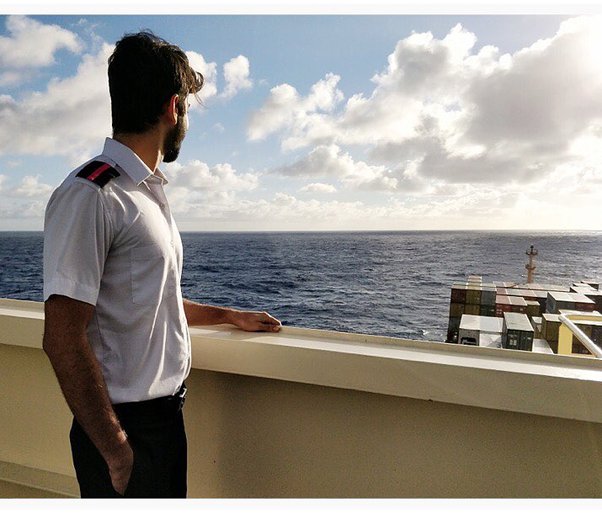

NRI quotas in Institutions

Whether it is education or occupation, every parent desires the best for their children. What if we tell you your NRI status holds more value than you ever imagined? The Medical Council of India reserves around 50% of medical seats under the NRI quota. This is not it; many prestigious business and engineering institutions around the country offer NRI quotas to the children of NRIs. Amazing right? After all, being a seafarer for years has given your children the benefit of dreaming big.

DISADVANTAGES OF BEING NRI

Some government and private schemes can not be availed.

If you actively sail as a seafarer, then Sukanya Yojana, NPS Schemes and Post Office schemes can not be used under your name. However, your spouse, if a resident of India, can easily register themselves under such government plans as these benefits are reserved only for residents of the country. Few private firms like Tata sell their share of fixed deposits in the market. They do not allow NRI professionals to buy their shares. Even though there are many good investment options in the market, few limitations exist for being an NRI seafarer.

Credit Card

How often do you call your bank to provide a credit card in your name? We know it is a long process, as banks are very skeptical about providing credit cards to NRI sailing professionals. With its ease of use and convenient pay-back options Credit cards have become an irreplaceable part of our lives. Credit Cards allow seafarers to make payments when they are abroad or in India easily. But due to fewer banks providing credit cards to sailing professionals, it has become quite an inconvenient process for sailors on duty.

Agriculture land

Under Fema and the foreign exchange management ( Acquisition and Transfer of Immovable Property in India) regulations, 2018, NRIs are not permitted to buy agricultural land or plantation property or farmhouses in India. However an NRI can inherit or receive such properties in gift from a resident of India. Also, seafarers can not buy such lands in their name or in the name of another person unless that person is a spouse, brother, sister or lineal ascendant or descendant.

Holding the status of NRI as a seafarer comes with merits and demerits. But if you love what you do, the inconvenience that comes along will fade with time, and you will be able to find a better alternative to existing problems.

Disclaimer :- The opinions expressed in this article belong solely to the author and may not necessarily reflect those of Merchant Navy Decoded. We cannot guarantee the accuracy of the information provided and disclaim any responsibility for it. Data and visuals used are sourced from publicly available information and may not be authenticated by any regulatory body. Reviews and comments appearing on our blogs represent the opinions of individuals and do not necessarily reflect the views of Merchant Navy Decoded. We are not responsible for any loss or damage resulting from reliance on these reviews or comments.

Reproduction, copying, sharing, or use of the article or images in any form is strictly prohibited without prior permission from both the author and Merchant Navy Decoded.